Effective Estate Planning ensures that your accumulated wealth, will be distributed to your chosen beneficiaries in such a way that maximises their inherited benefits and minimises tax, fees, and exposure to predators.

A thorough Estate and Inheritance Plan:

- Provides a clear roadmap for loved ones of what, when, how you’d like your wealth distributed, and perhaps explains why, so that your family understands your motives.

- Gives guidance on what is to happen if you become sick, incapacitated, or die prematurely.

- Provides safe accessible storage and collation of all documents needed for administering the estate distribution.

- Gives clear directions on business succession planning.

- Protects beneficiaries from predator attacks, unintended inequity, and excessive tax.

- Protects your wealth through appropriate use of a special leading member asset-protection trust.

The disappointing reality:

- Only 47% of Australians are understood to have a legitimate will, acceptable for granting probate.

- The majority of these wills won’t protect your assets the way you hope. Generally speaking, these wills are prepared in isolation by general-practice lawyers, without collaboration with the testator’s accountant who should understand the business structure, background and inherent risks better than anyone.

- Who prepared your will and how long ago?

Lawyers don’t develop ‘Estate Plans’…..they draft wills!

With a simple cheap signed Will and perhaps some life insurance, many pop the champagne thinking the job is done. But there’s so much more to an Estate Plan than merely a well drafted will!

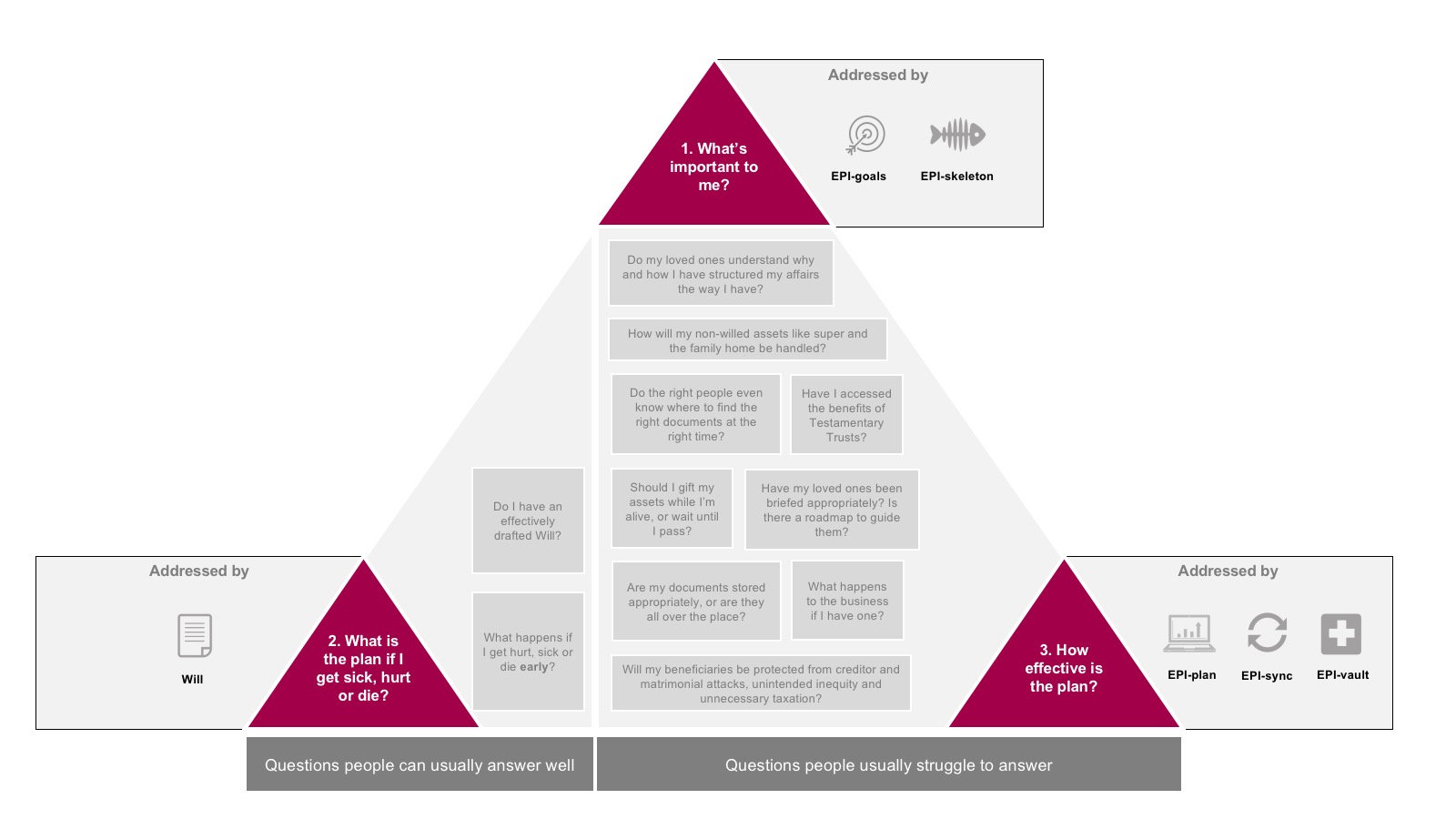

With our ‘Estate Planning for Life’ process, you will be able to systematically cover all bases and ensure nothing is left to conjecture or become a burden for chosen executors!

Your affairs are not entirely simple. Contemplate, if you will, that at the time of your passing, it may be even more complex than it is now! The EPI-centre professional service offering is designed to fill the “information void” commonly found between the awareness (and files) of a Willmaker’s tax accountant, financial planner and their solicitor, and to guide appointed Attorneys and Executors when they are required to act. EPI-centre offers a unique and specialised service, achieved through our 7-Step Process outlined below

To highlight the Estate Planning Gap our Process solves, consider the following:

The Estate Planning Process Should:

Challenge the relevance of retaining specific assets to the end, rather than disposing of them or possibly gifting them during your lifetime. If you choose to retain them, it should also be determined how best to hold the assets and how and when to change this (giving due consideration to issues such as Capital Gains Tax, asset protection, Stamp Duty etc).

Wills, However:

Merely direct these assets to one or more beneficiaries if still held at the time of death. It is too late for Executors to alter tax implications for the deceased in arrears, or for beneficiaries going forward.

The Estate Planning Process Should:

Contemplate the virtues of which family members or entities should optimally hold certain assets e.g. jointly as joint tenants or tenants-in-common, in family trusts, or maybe a Self-Managed Super Fund.

Wills, However:

Can importantly, only direct Executors to deal with the assets identified as being held by the deceased (i.e. not held inside trusts, companies or superannuation).

The Estate Planning Process Should:

Contemplate a Willmaker’s wealth held as a member in superannuation and the optimal tax outcomes in passing member death benefits to surviving family members.

Or otherwise, contemplate reverting a super pension stream of deceased member, most tax effectively, to eligible dependants.

Wills, However:

Have no power at first instance to deal with superannuation assets on death, which are governed by your super fund trust deed and validly prepared member death benefit nominations.

The Estate Planning Process Should:

Contemplate the succession of future control of trusts, companies and their underlying assets and liabilities, including who should become the new directors and appointors. Also, should and how would group family affairs be restructured to achieve identified Estate Planning objectives.

Wills, However:

Can only cause distribution of assets held at date of death.

01.

Who would get your home? Where would your loved ones live if you passed unexpectedly yesterday?

Your Super and assets held as joint tenants (for example, your family home usually) are generally not governed by your will.

02.

Do you have children and stepchildren? Have you been divorced or left a common law marriage? Have you revoked your previous wills?

Wills are automatically revoked by marriage... but NOT so by divorce! Particularly if you’re a blended family, failing to update your will could have catastrophic effects on ALL those left behind.

03.

How would your family cope financially if you were incapacitated or killed yesterday?

Wills cannot be made or changed once you lose legal capacity. Sudden accidents happen, and if injured, you and your family still need to be provided for.

04.

Do you have a Testamentary Trust option for beneficiaries built into your will to safeguard your family’s financial future?

With planning now, Testamentary Trusts come into existence upon a testator’s death, with special clauses drafted and embodied in a Will. They provide safety and are highly tax-efficient, especially where income derived from the assets willed into the trust can be streamed to family members, even babies, who have little or no other income.

If you’ve been through a family change or restructure, it’s time to update your will and build an estate plan. If any of your children have married, divorced, re-partnered, had children, or moved out of home since your last will, you need to update and manage their implications.

Blended family? It is possible to restrict beneficiaries to the bloodline. If you’ve re-partnered but want your wealth to benefit your biological family, it’s possible to ensure this through the Leading Member principle available by way of option in the legal documents sourced for you by EPI-centre.

Contact Us